Qualified Products

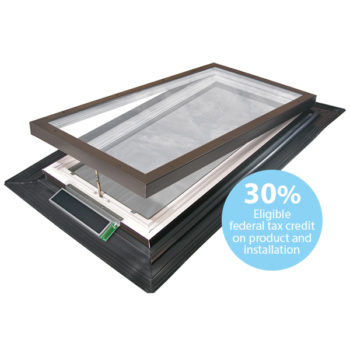

Wasco Solar Powered E-Class Model EVMS qualifies for up to a 30% Tax Credit on both the purchase and installation under “Solar Electric Property” expenditures when purchased and installed through December 31, 2021.

Wasco Solar Powered E-Class Model EVMS qualifies for up to a 30% Tax Credit on both the purchase and installation under “Solar Electric Property” expenditures when purchased and installed through December 31, 2021.

What You Should Do

After Installation

- Keep your receipts for total price paid (invoice from contractor for product and installation) of the qualifying VELUX products.

- Attach receipts to a completed Manufacturers Certification Statement1 and keep for your records (Download Statement).

When Filing Your Taxes

- Fill out the IRS Residential Energy Efficient Property Credit tax form 5695 (under “Qualified solar electric property cost”)

- Submit it with your taxes. Enter this tax credit off of form 5695 on your IRS tax form 10402 (tax forms can be found at www.irs.gov).

2009-2019: Save 30% Federal tax credit

2020: Save 26% Federal tax credit

2021: Save 22% Federal tax credit

Background

Under two laws – the Emergency Stabilization Act of 2008 and American Recovery and Reinvestment Act of 2009 (ARRA) – Solar Powered E-Class Model EVMS qualifies under “Solar Electric Property” expenditures when purchased and installed from January 1, 2009 through December 31, 2021 in the US. This tax credit is a direct debit of the taxpayers total tax liability. The combined effect of these two laws provides up to a 30% Tax Credit on both the purchase and installation of qualifying products in renewable technologies such as; Solar Electric Property, Residential Solar Water Heating, Qualified small wind energy and qualified Geothermal Heat pump energy as well as others.

1) IRS Notice 2009-41 suggests the taxpayer is not required to attach this certification statement to their tax return. However, the taxpayer should retain this certification statement as part of their tax records.

2) As in all tax matters, the taxpayer is advised to consult their tax professional. VELUX America LLC assumes no liability regarding the homeowner’s ability to obtain tax credits.